Is 70 the New 65?

The Canadian Business Journal reports, Raise retirement to 67, think tank says:

The Canadian Business Journal reports, Raise retirement to 67, think tank says:A policy think tank believes increasing retirement eligibility by two years may fix an impending demographic crunch.The Mowat Centre for Policy Innovation, a think tank affiliated with the University of Toronto, published a report today calling for a raise in eligibility ages for the Canadian Pension Plan and Quebec Pension Plan from 65 to 67, and the earliest ages from 60 to 62.

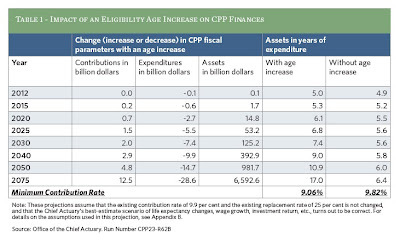

“By 2050, an age increase would reduce CPP expenditures by about $15 billion per year and increase contribution revenues by about $5 billion per year,” the report said. “Increasing the eligibility ages is a fair solution for financing the costs of population aging, because doing so divides these costs across younger and older generations.”

The report, Is 70 the New 65? Raising the Eligibility Age in the Canada Pension Plan, was written by Martin Hering and Thomas R. Klassen, compared Canada's situation to similar legislation enacted in Australia, the United States and throughout Europe.

You can download the full report by clicking here. Table 1 above shows that even though the retirement age increase would be implemented gradually over a relatively long period of time, its impact on the CPP’s finances would be significant after 2025:

The study is interesting but increasing the retirement age to 67 will not be easy. Also, I worry that if we do increase it to 67, then in a few years, who is to say policymakers won't try to increase it again to 70? Nevertheless, with people living longer and healthier lives, increasing the retirement age may be an option worth exploring.Specifically, policy makers could reduce the CPP’s minimum contribution rate (the rate required to sustain the CPP), from the current 9.82 to 9.06 per cent, without affecting benefit levels and while maintaining the required size of assets.8 Alternatively, benefits could be increased over time while maintaining current premium levels.

A reduction of the minimum contribution rate from 9.82 to 9.06 per cent would create a significant buffer between the minimum and the legislated contribution rate. This would make it more likely that plausible demographic and economic developments— such as a higher than expected increase in life expectancy, a slower than expected growth of wages, or lower than expected investment returns—would have a much smaller impact on the sustainability of pension finances and would reduce the need for significant policy shifts, including increased premiums or reduced benefits.

The table also shows that a gradual increase in retirement ages increases contributions and decreases expenditures each year, so that by 2050 the CPP has $982 billion more in assets than otherwise would be the case. An important measure of the CPP’s financial health is the assets in years of expenditure: by 2050, the CPP would have assets of 11 years of expenditure, and thus twice the legal minimum of 5.5 years. Put differently, the plan’s funding would grow from about 25 per cent to about 50 per cent of liabilities.

The consequence is that an increase in eligibility age creates a cushion for the CPP, allowing the existing contribution rate of 9.9 per cent to remain unchanged if demographic and economic conditions were more unfavourable than expected. In our projections, we assumed that employees would delay their retirement by 2 years and used the same assumptions regarding retirement rates that the Chief Actuary used in the 2006 actuarial report on the CPP (see Appendix B). Specifically, we expected that about 40 per cent of workers retire at the earliest retirement age, about 30 per cent at the normal retirement age, about 20 per cent between the earliest and normal retirement ages, and less than 5 per cent after the normal retirement age.

The assumption that a very high proportion of workers— about 40 per cent—chooses to receive an actuarially reduced CPP benefit at the earliest possible age primarily reflects the role of private retirementincome sources, especially occupational pensions, in the retirement decisions of individuals (Wannell 2007b, 2007a). The assumption that Canadians would change their behaviour significantly and delay their retirement by 2 years allows us to estimate the potential size of the effect of a retirement age increase. If individuals did not delay their retirement by as much as we assumed, the impact of an age increase on the minimum contribution rate and on the level of funding would be smaller than that shown in our estimates.

Even though an increase of eligibility ages would certainly lead to savings because individuals would have to postpone their receipt of CPP benefits at least until age 62 and would receive reduced benefits if they retired before age 67, it would not force them to wait until age 67. For example, workers who plan to retire at age 65 could still do so if they accept a permanent actuarial reduction of their pension by 14.4 per cent. In this case, the retirement age increase from 65 to 67 would reduce expenditures but would not increase contribution revenues.

***Feedback***

Bernard Dussault, former Chief Actuary of Canada had this to share with me on this topic:

Current CPP contributors pay too much (9.9% rather than 5.5%) to the CPP because their predecessors:

- did not pay enough into it (3.6% for 20 year, increased to 6% by 1996, etc.) and

- got full accrual of benefit rights after 10 rather than 47 years.

Why would/should we consider penalizing further the current contributors by increasing the pensionable age? The 9.9% remains somewhat sufficient to afford the payment of pensions commencing at age 65.

...

There is no new issue with the CPP. It had big ones that were addressed through the 1998 reform. Its partly funded status is due to the insufficient contributions made from 1966 to 1996 and to granting full accrued benefits after only 10 years of contributions to the original (1866) cohorts of contributors, which gave rise to a huge deficit, too huge to ever be amortized. Therefore , our children, grand children, grand-grand children and so on will have to pay 9.9% (half paid by employer) rather than 5.5%. Pure case on intergenerational inequity.

The CPP is not a target benefit plan and not meant to be one. The decreased in future benefits in 1998 (the then current pensioners were not affected) was one good mean to correct errors (re: insufficient contributions) of the past. Real target plans do not allow known insufficient contributions. In 1966, it was clearly reported that the CPP 3.6% contribution rate was insufficient. It was a political decision to go ahead with the 3.6% and leave the problems to future generations.

Comments

Post a Comment